Nonprofit Budgeting Best Practices: Why You Need Multiple Budgets for Smarter Financial Management

- Aug 17, 2025

- 4 min read

Nonprofits exist to make a difference, but achieving your mission requires smart financial planning. One of the most common challenges is managing budgets effectively. Many organizations rely on grant budgets lined up side by side. While that may work for a while, it often leads to inefficiencies, compliance risk, and missed opportunities.

A better approach is to adopt nonprofit budgeting best practices by building three complementary budgets that work together:

Grant-specific budgets

Program-specific budgets

A general organizational budget

This guide explains why each budget is essential, how they connect, and how to implement them to maximize funding, transparency, and impact.

Grant-Specific Budgets: Keep Restricted Funding on Track

Grant budgets are the bread and butter for many nonprofits. Each grant comes with rules, restrictions, and reporting requirements. A grant-specific budget outlines exactly how funds will be used to meet the deliverables in the grant agreement.

Why it matters:

Ensures compliance with funder restrictions and timelines

Supports accurate, timely reporting that builds funder trust

Prevents accidental misuse of restricted funds

Limitations:

Grant budgets focus on individual funding streams. Alone, they won’t show whether your nonprofit is allocating resources efficiently across programs or covering all costs.

Program-Specific Budgets: Align Dollars to Mission and Outcomes

Program budgets are built around your nonprofit’s core areas of impact—education, advocacy, housing, health, or community support. Aim for 2–3 core programs to maintain focus and efficiency.

Why it matters:

Reveals the full cost of each program, including indirect costs (staff time, rent, technology, insurance)

Combines multiple funding sources—grants, donations, sponsorships—into one coherent plan per program

Helps ensure each program is fully funded and sustainable, rather than patchworked from separate grants

Example:

A single program may be supported by multiple grants and individual donations. Some grants allow a portion for administrative or indirect costs. Without a program-specific budget, it’s hard to coordinate those sources or demonstrate the true cost per outcome.

General Organizational Budget: See the Big Picture

The general budget ties everything together. It consolidates all program and grant budgets into one plan that shows how your nonprofit operates as a whole. It includes administrative costs, shared staff, fundraising, technology, and other operational expenses that might not fit neatly into a single grant or program.

Why it matters:

Ensures all funding is used efficiently and strategically across the organization

Prevents double-dipping by clearly allocating expenses and cost shares

Provides a clear view of financial health for your board, funders, and auditors

With a comprehensive general budget, you avoid lining up grant budgets in isolation and instead create a unified financial strategy that advances your mission.

Why You Need All Three Budgets

Nonprofits operate in a complex funding landscape. One grant might support multiple programs; other grants may allow administrative costs; unrestricted gifts can fill gaps. Without multiple, connected budgets, it’s easy to:

Overallocate funds to a single program or line item

Leave unrestricted dollars unused or misapplied

Struggle to demonstrate transparency and accountability

Using all three budgets together enables you to:

Maximize fund usage: Allocate every dollar effectively without leaving money on the table

Avoid double-dipping: Track which expenses each funding source covers

Stay mission-focused: Ensure dollars flow to priority outcomes and strategies

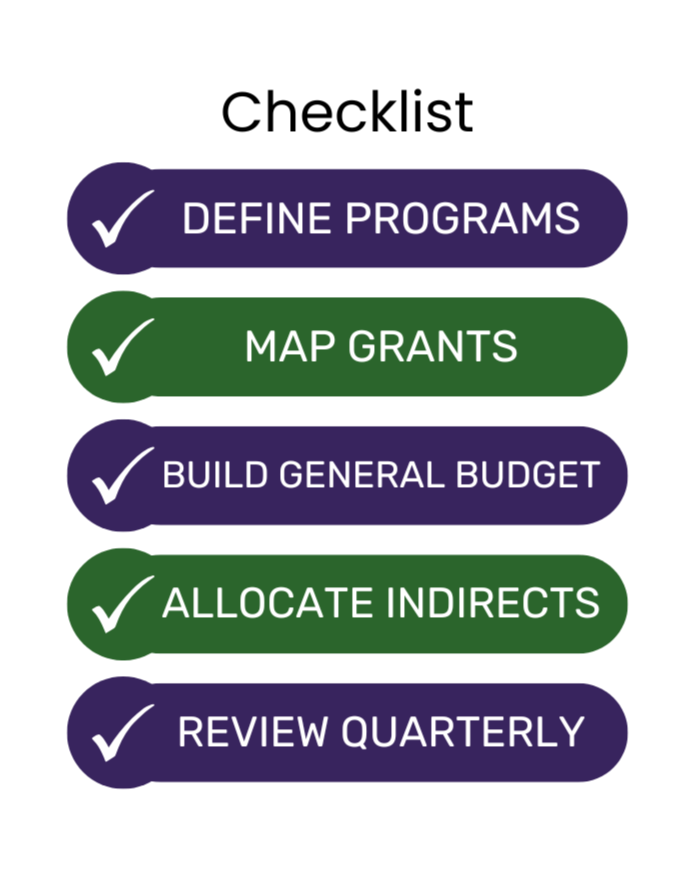

Practical Nonprofit Budgeting Best Practices

Start with programs: Define 2–3 core programs and build program-specific budgets first, including direct and indirect costs

Layer in grant budgets: Map each grant to the program(s) it supports and align to funder restrictions and reporting calendars

Build the general budget: Consolidate program and grant budgets, add organization-wide admin, fundraising, and shared services

Allocate indirects fairly: Use a consistent cost allocation method (e.g., staff hours, square footage, or direct cost base)

Use budgeting software: QuickBooks, Excel with templates, or nonprofit tools (e.g., Sage Intacct, MIP, Jitasa, Aplos) to keep budgets linked

Create a calendar: Align budget reviews with board meetings and grant reporting deadlines

Review quarterly: Update for new grants, program changes, or variances; reforecast year-to-date and year-end

Tie to outcomes: Pair budgets with program metrics (units served, outcomes achieved, cost per outcome)

Simple Structure for Each Budget

Revenue: Grants, individual donations, corporate gifts, events, and earned income

Direct costs: Program staff, supplies, travel, contractors

Indirect costs: Rent, utilities, insurance, admin staff, IT, accounting

Allocations: Method and percentages for shared costs

Timeline: Monthly or quarterly burn rate and reporting milestones

Notes: Restrictions, match requirements, and deliverables

Common Pitfalls to Avoid

Funding programs only with restricted grants and ignoring sustainability

Underestimating indirect costs or failing to claim allowable admin/overhead

Not reconciling grant budgets to the general ledger and program budgets

Managing budgets annually without midyear reforecasts

Vague cost allocation that won’t withstand audit scrutiny

Conclusion

Budgeting isn’t just about managing money—it’s about managing your mission. By implementing nonprofit budgeting best practices—grant-specific budgets, program-specific budgets, and a general organizational budget—you’ll maximize funding, ensure compliance, and strengthen transparency. Start by identifying your core programs, then build connected budgets that work together to support your mission and deliver measurable impact.

Call to action

Ready to upgrade your budgeting process? Map your core programs, list current grants and restrictions, and build a consolidated general budget that aligns dollars to outcomes. Your mission—and your funders—will thank you.

Comments